Plastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

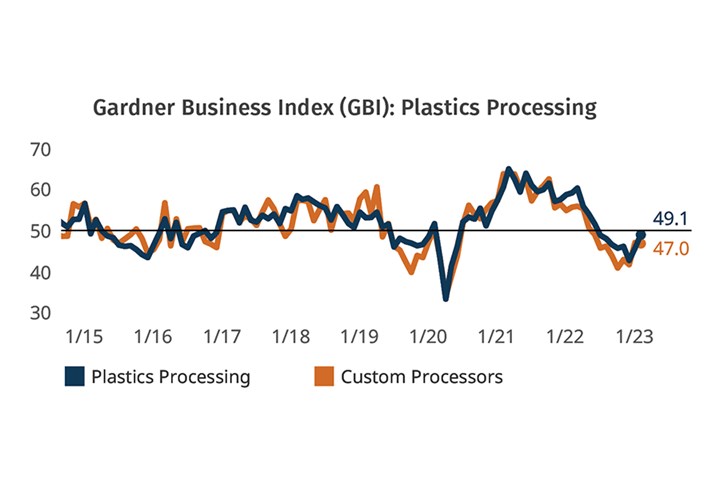

While contracting for the eighth month straight, the rate of contraction of plastics processing activity slowed in February, continuing a trend that began in January. The Gardner Business Index for Plastics Processing closed February up four points, to 49.1, landing close to July’s index that launched the eight-month contractionary period. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

FIG 1 Plastics processing activity contracted again in February for both custom processing and total processing, but the latter inched closer to flat.

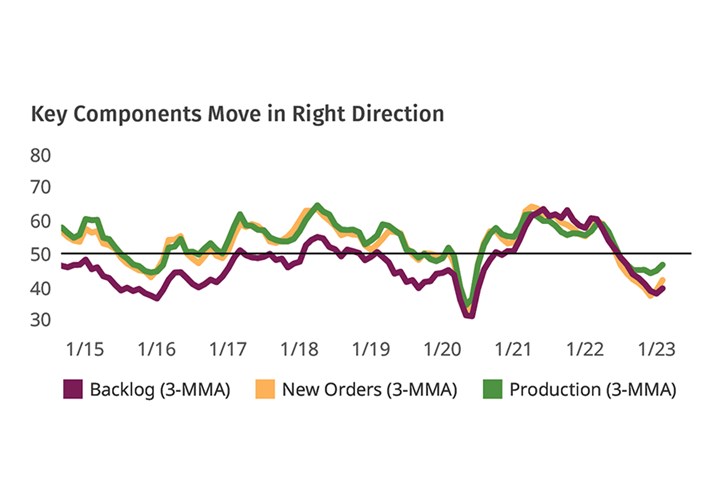

The GBI sub-index for new orders appeared to be leading the way — still contracting, but at a slower rate in February. As expected, production activity and backlogs followed suit. February export and employment activity stayed about the same as last month, both still contracting, with employment inching ever-so-close to flat, where it has hovered for five months. There was no pressure on supplier deliveries in February, reinforcing that any uptick in plastics activity is not going to stress the system. In fact, supplier deliveries that have been lengthening at a slowed rate for months threatened to shorten in February.

FIG 2 Drivers of plastics processing activity contracted at slower rates in February.

If the past 12-month supplier deliveries trend continues into March, there will be a shortening of supplier delivery times for the first time in three years. The supplier deliveries trend also suggests supply-chain issues that artificially lengthened supplier deliveries for months have resolved or have otherwise lost their impact. The GBI Plastics Processing Index and component activity are encouraging, but far from “on fire,” so cautious optimism is recommended. Overall business activity for custom processing stayed about the same, contracting to a greater degree than total plastics processing in February.

EDITOR’S NOTE: Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Plastics Processing Index serves as a great tool for making data-driven decisions. Thank you to everyone who has previously completed GBI surveys. Your participation helped increased response in 2021-2022, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

ABOUT THE AUTHOR: Jan Schafer is director of market research for Gardner Business Media, parent company of both Plastics Technology magazine and Gardner Intelligence. She has led research and analysis in several industries for over 30 years. She has a BA in psychology from Purdue University and MBA from Indiana University. She credits Procter & Gamble for 15 years of the best business education. Contact: (513) 527-8952; jschafer@gardnerweb.com.

Related Content

Processing Slips as Summer Simmers

Monthly index suggests slower growth in June for plastics processors overall and contraction for custom firms.

Read MorePlastics Processing Contracts Again

October’s reading marks four straight months of contraction.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry.

Read MorePlastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

Read MoreRead Next

Recycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More