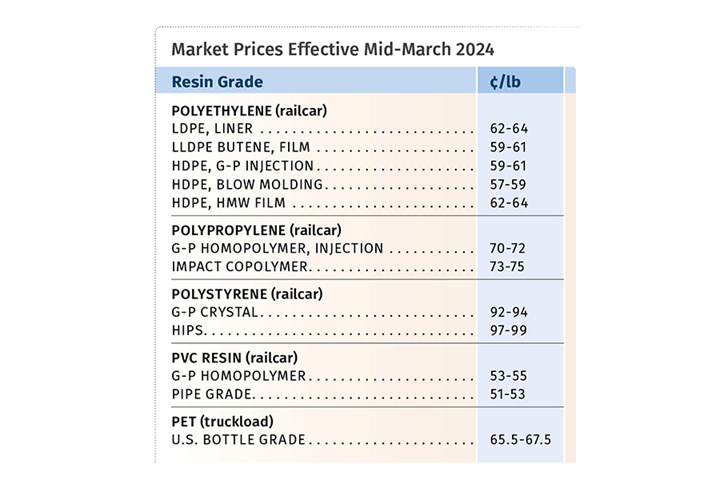

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Prices for all the volume resins were on an upward trajectory as first quarter’s end approached. Price escalation of key raw materials/feedstocks was the driving factor in most cases, though some production issues contributed to a relatively short-term tightness for a few of these resins, as did logistical delays and higher freight costs. Supply/demand fundamentals did not play a role, with supply of nearly all of the volume resins characterized as balanced-to-ample and demand somewhat improved over relatively dismal demand in fourth quarter 2023.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers, Mike Burns of Plastic Resin Market Advisors, and resin pricing expert Robin Chesshier.

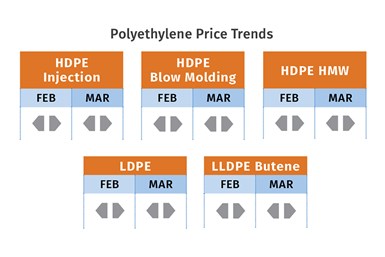

PE Prices Up, Then Flat?

Polyethylene prices in January moved up by 5¢/lb, although competitive situations were underway for nonmarket adjustments. Meanwhile, suppliers were seeking increases of 5¢ for February and some split a 6¢/lb increase for February and March, according to PCW’s Associate Director for PE, PP and PS David Barry, The Plastics Exchange Greenberg, Mike Burns of Plastic Resin Market Advisors, and resin pricing expert Robin Chesshier.

PCW’s Barry saw some resin price stability underway and ventured the February-March increases are unlikely to go through, noting that suppliers were “lucky” to get the January price hike. This is in view of the fact their raw material costs are at an all-time low, and they have continued to have strong exports activity, making their profit margins healthy. He characterized domestic demand within the first quarter as better than 2023’s fourth quarter. Suppliers’ plant operating rates stood in the mid-80s percentile, owing to significant new capacity that is being brought on stream by such companies as Shell and NOVA.

Plastic Resin Market Advisors’ Burns and resin expert Robin Chesshier similarly ventured that the January increase was unlikely to be sustainable through the middle of the year. Says Burns, “The suppliers’ determination to increase North American pricing remained steadfast. The December and January combined export volume equaled the all-time highest two-month total and contributed to the short-term inventory draw. As the North America market returns to average demand, coupled with continued strong production levels, (it) should enable resin markets to challenge recent increases over the next several months.”

The Plastic Exchange’s Greenberg characterized spot resin availability as mostly snug, as suppliers have been very disciplined with production while exporting as much as they can. Spot prime PE grades were flat but firm, though HDPE for blow molding trudged another cent higher. He noted that while a bullish sentiment has kept upward pressure on the market, it was not enough for suppliers to secure their entire February 5¢/lb.

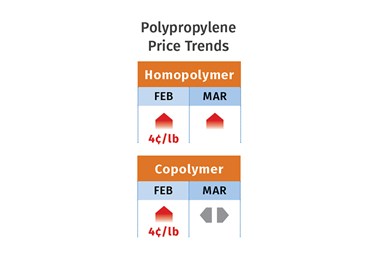

PP Prices Up

Polypropylene prices were expected to move up 4¢/lb in February, having moved up 3¢/lb in January, in step with propylene monomer. However, nearly all major PP suppliers had issued price increases of 3¢/lb to 4¢/lb for the February-March time frame, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. Both Barry and Newell ventured that it was unlikely that February would end up with an increase for PP, in addition to that associated with the monomer.

According to Barry, prices in March could go up a bit more depending on resolved supply issues from propylene-on-demand (PDH) plants and startup of planned maintenance at crackers and refineries. He noted that while domestic demand for PP in first quarter was shaping up to be better than fourth quarter 2023, it is not robust and the PP market could see destruction as in processors moving to other materials and/or imports of resins or finished goods if feedstock costs keep going up. He estimated PP suppliers’ production rates in the high-70s to low-80s percentile. Spartan Polymers’ Newell ventured that suppliers’ nonmonomer increases had little chance to go through in February or March., noting that domestic demand was not good enough and that increases are feedstock driven. In approaching April, however, he saw more volatility, as propylene inventories are tight and plant changeovers were scheduled for both PDH plants and at crackers and refineries.

The Plastic Exchange’s Greenberg reported that the PP spot market became even tighter by February’s end following Braskem’s force majeure announcement. “This is the second supplier in two months to have declared a force majeure on PP, with Ineos doing so at its Chocolate Bayou, Texas, facility in January. After a difficult 2023, we feel that their production discipline these past few months, in the face of rising costs, has put them in the position to reap a little reward.”

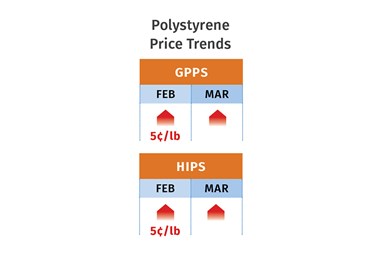

PS Prices Up

Polystyrene prices moved up 5¢/lb in February and were largely expected to move up by another 5¢/lb to 6¢/lb in March based on the volatility of raw materials, particularly benzene, according to PCW’s Barry and resin pricing expert Robin Chesshier. Barry notes that the March issue could be the last increase, depending on when refineries start up after planned maintenance, but also noted that benzene prices typically move up during the driving season. Chesshier notes that some relief in prices had potential for April if benzene prices dropped to under $4/gal.

Both Barry and Chesshier note they do not see the return of the typical strong seasonal demand for PS that starts in second quarter, and that 2023 was a strong indication of that. The implied styrene price based on a spot formula (70% benzene, 30% ethylene) was up 3¢/lb higher through most of February.

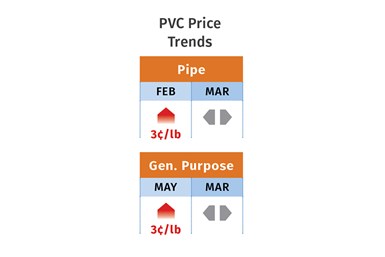

PVC Prices Up, Then Flat?

PVC prices in January did settle flat as had been expected, but suppliers were out with increases, largely being pushed up to February, according to Paul Pavlov, RTi’s v.p. of PP and PVC, and PCW’s Associate Director PVC and Pipe Donna Todd. They reported that all major suppliers pushed up and revised their January 5¢/lb increases to 3¢/lb for February, which were implemented.

Industry forecasts for March were for another 2¢/lb increase, which led to one major supplier issuing a 3¢/lb increase for March, but Pavlov ventures that PVC prices were likely to be flat for both March and April. He notes that PVC feedstock prices were low, exports prices were much lower and global prices were dropping. Moreover, new capacity coming on stream would just add to an already well-supplied market. He notes that first quarter 2024 PVC prices are about 10% lower than first quarter 2024.

Todd reports, “Buyers saw these moves as more than a wisp of desperation after the failure of suppliers’ January price hike attempt. “Converters were convinced prices would not move up anywhere close to 5¢/lb to 6¢/lb for February, barring an explosive plant accident or natural disaster between now and the time the market settles at the end of March.”

PET Prices Up

PET prices moved up another 2¢/lb in February, after a 1¢/lb hike in January, based on raw material formulation costs. This after dropping a total of 7¢/lb in the fourth quarter, according to Mark Kallman, RTi’s v.p. of PVC, PET and engineering resins. He ventures that PET prices in March would move up an additional 1¢/lb to 2¢/lb and could be flat in April, depending on prices of paraxylene easing up. He notes that PET imports, which now have higher freight costs of 4¢/lb to 6¢/lb are still advantageously priced over domestic resin. He characterizes demand as steady, without signs of second quarter seasonal demand uptick, though that was expected this month.

ABS Prices Up

ABS prices were on the way up in first quarter, after remaining flat throughout first quarter, according to RTi’s Kallman, but the trajectory was changing. This was due primarily to price escalations in key raw materials, including benzene, butadiene and acrylonitrile. Suppliers were out with increases of 7¢/lb to 9¢/lb within the February-March time frame. Kallman ventured that about half of those increases would be implemented by April, owning largely to lackluster demand and cost-advantaged imports.

PC Prices Up

Polycarbonate prices dropped between 3¢/lb to 5¢/lb in the January-February time frame, but a transition was taking place due to higher feedstock costs, primarily benzene, according to RTi’s Kallman. Price increase nominations were out for 10¢/lb by major suppliers. Kallman ventured that by April, some of those increases — most likely below 5¢/lb — would be implemented. This due to continued static demand, ample supply and well-priced imports.

Prices of Nylon 6, 66 Up

Prices of nylon 6 and 66 were on the way up as the trajectory of downward pricing from last year reversed, according to RTi’s Kallman and resin expert Robin Chesshier. Key factors include higher costs of key feedstocks such as benzene and caprolactum, but also due to a tightening of supply because of production issues and delayed supply issues going through the Panama Canal.

Effective March 1, companies such as BASF and AdvanSix (previously Honeywell) issued price hikes for nylon 6 and nylon 66 of 20¢/lb, while Nylon Corp. of America (NYCOA) issued price hikes for nylon 6 and nylon 66 of 18¢/lb to 24¢/lb, respectively. Kallman notes these increases were “a big ask,” considering that raw material costs were up between 5¢/lb and 7¢/lb. As such, he ventures that by the end of first quarter, price hikes implemented would fall in the range of 5¢/lb to 10¢/lb.

Related Content

Tracing the History of Polymeric Materials: Aliphatic Polyketone

Aliphatic polyketone is a material that gets little attention but is similar in chemistry to nylons, polyesters and acetals.

Read MoreLanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

Read MoreTracing the History of Polymeric Materials: Acetal

The road from discovery in the lab to commercial viability can be long, and this was certainly the case for acetal polymers.

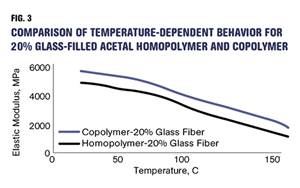

Read MoreHow Do You Like Your Acetal: Homopolymer or Copolymer?

Acetal materials have been a commercial option for more than 50 years.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More